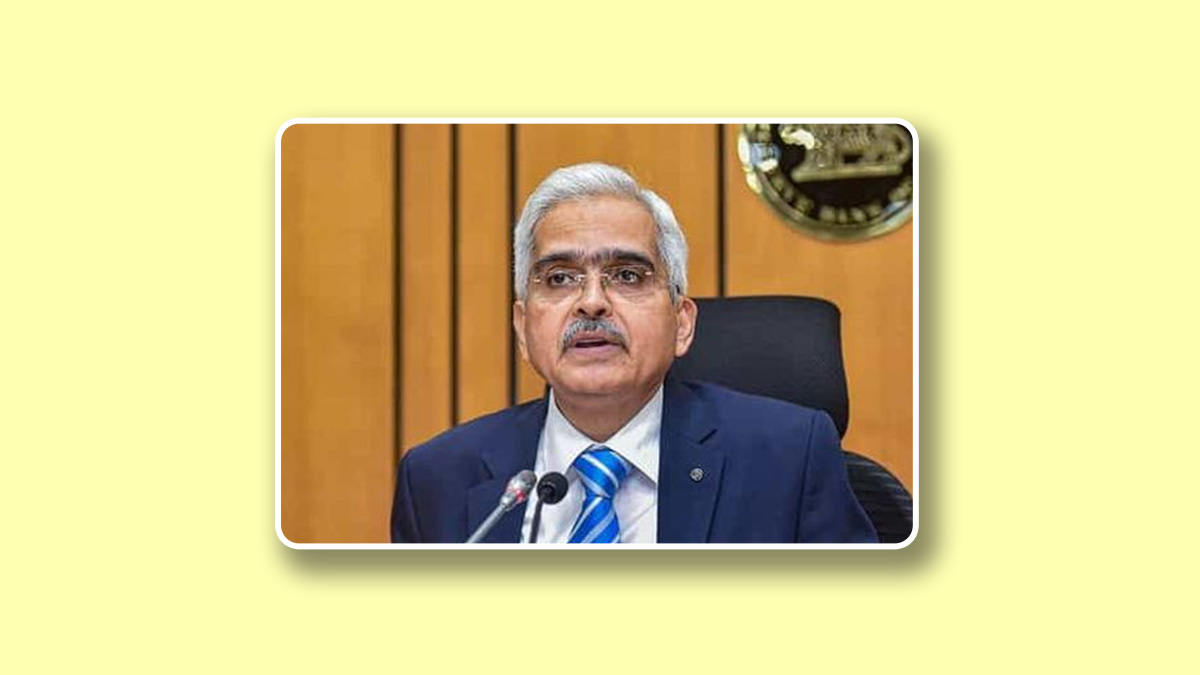

Reserve Bank of India (RBI) Governor Shaktikanta Das has provided reassurance regarding the impact of regulatory actions on Paytm Payments Bank Wallet users, indicating that 80-85% of them will remain unaffected.

He advised the remaining users to link their apps to other banks in response to the RBI's decision on January 31 to prohibit Paytm Payments Bank Ltd (PPBL) from accepting deposits, credit transactions, or account top-ups.

Users have until March 15 to link their wallets to alternative banks, with no extensions planned beyond that date. Das clarified that the RBI's action targeted PPBL specifically and not Fintech companies overall, emphasising the RBI's continued support for financial technology innovation.

"RBI is and remains fully supportive of fintech... RBI is all for fintech to grow," Das reiterated in an interview, employing a metaphorical analogy that owning and driving a Ferrari necessitates adherence to traffic rules to avoid accidents.

Regarding the fate of the Paytm payment app license, Das explained that the National Payments Corporation of India (NPCI) will soon make a decision. "So far, as RBI is concerned, we have informed them that we have no objection if NPCI considers the Paytm payment app to continue because our action was against the Paytm payment bank. The app is with the NPCI... NPCI will take a call... I think they should be taking a call shortly," he stated.

Don't Miss: Delhi Painter Regains Hands In Groundbreaking Transplant

Following the regulatory actions, Paytm Payments Bank Wallet (Paytm Removed From NHAI List For FASTag Payments: List Of Banks That Are Still Authorised) Limited changed its board composition. Promoter Vijay Shekhar Sharma resigned as part-time non-executive Chairman, leading to a reconstitution of the board. Presently, the board includes former Central Bank of India chairman Srinivasan Sridhar, former Bank of Baroda Executive Director Ashok Kumar Garg, and two retired Indian Administrative Service (IAS) officers.

In addition to the developments surrounding Paytm Payments Bank Wallet and Paytm wallet, Das commented on economic growth, forecasting a GDP growth rate close to 8% for the current year, with a projected 7% growth for the following financial year.

Despite the latest inflation rate of 5.1%, which is 110 basis points above the 4% target, Das noted a declining trend in inflation and reiterated the RBI's (Repo Rate Remains Fixed At 6.5 Per Cent; 5 Ways Decision Of RBI Will Affect The Middle-Class) commitment to achieving the target sustainably.

Image Courtesy: Facebook

Stay tuned to HerZindagi for more such content.

Also watch this video

Herzindagi video

Our aim is to provide accurate, safe and expert verified information through our articles and social media handles. The remedies, advice and tips mentioned here are for general information only. Please consult your expert before trying any kind of health, beauty, life hacks or astrology related tips. For any feedback or complaint, contact us at [email protected].