In an era where casual dating and fleeting connections have become commonplace, ZikiLove has launched what it calls the world's first relationship insurance, creating significant buzz across social media platforms. This innovative concept provides financial incentives for couples who demonstrate long-term commitment, effectively turning relationship stability into a rewarding investment opportunity.

ZikiLove's insurance programme operates on a straightforward premise, couples invest an annual premium for five consecutive years. If their relationship culminates in marriage, they receive ten times their total investment. However, if they separate during this period, they forfeit their entire investment, walking away with what ZikiLove describes as "life experience and emotional damage."

View this post on Instagram

According to ZikiLove's website, the insurance process follows four distinct stages. First, participants must "find their 'The One' (or at least someone who isn't texting their ex on the side)." Once committed to a partner, couples begin making annual premium payments ranging from ₹5,000 to ₹1,00,000, with the amount determined by their confidence in the relationship's longevity.

ZikiLove requires the relationship to endure for a full five-year period, explaining that this extended timeframe ensures couples have progressed beyond the initial ‘honeymoon phase.’ As stated on ZikiLove's platform, this functions as "a loyalty test, but instead of airline miles, you get cold, hard cash."

Upon successful completion of the five years and subsequent marriage, ZikiLove delivers the promised tenfold return on investment. The company playfully promotes this substantial payout as solving wedding expense concerns, "No need to sell a kidney for wedding expenses. We'll make sure you marry like the Ambanis (minus the celebrities in a bus)," according to the ZikiLove website.

ZikiLove officially announced its unique service through Instagram, stating, "Introducing ZikiLove Insurance, the first-ever insurance that pays you for staying loyal in a relationship. In a time where breakups and situationships are more common than ever, we're changing the game. Pay a premium every year for five years, and if you marry your partner, we'll give you 10x your investment for your wedding. If you break up, you get nothing."

This direct approach highlights ZikiLove's positioning as a solution to modern dating challenges, framing relationship stability as both emotionally and financially rewarding.

Don't Miss: Do Astrology and Zodiac Sign Compatibility Play A Role In New-Age Dating? Survey Reveals Surprising Findings

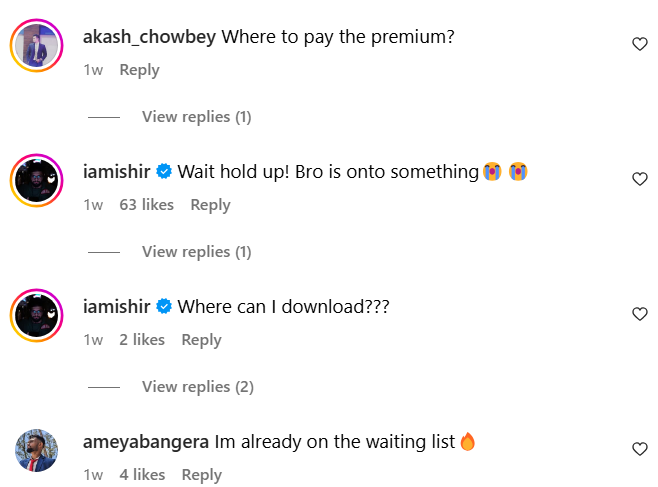

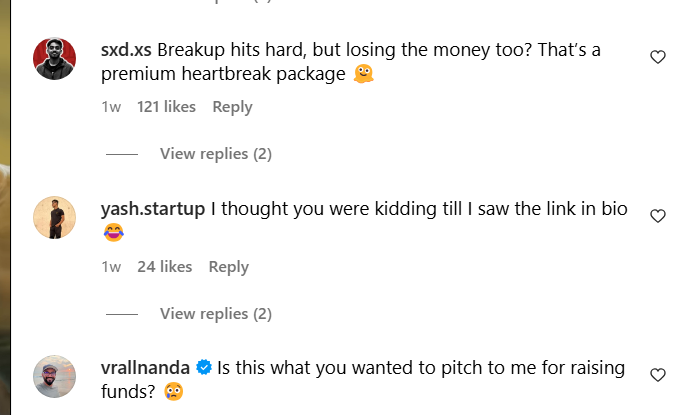

The announcement has generated diverse reactions across social media platforms. Some users view ZikiLove's concept as an innovative approach to encouraging commitment, while others question the ethics of monetising romantic relationships.

Positive responses include comments like "best investment yet" from user Rayhaan Mahem, while Ameya Bangera enthusiastically shared, "I'm already on the waiting list." Another user, Akash Chowbey, showed immediate interest by asking, "where to pay the premium."

Skeptics have also voiced concerns, with user sxd.xs commenting, "Breakup hits hard, but losing the money too? That's a premium heartbreak package." Rachna Shenoy offered a more reflective perspective, "Ohhh only way to live in a good relationship without breaking up in this era ig?"

ZikiLove frames its service as a response to contemporary dating challenges. As stated on their website, "In a world of ghosting, cheating, and 'he's just a friend' excuses, finding true love is harder than ever. That's why we created a financial safety net for your heart—because if love is a gamble, shouldn't you at least get paid for winning?"

Don't Miss: Divorce Tips 101: Mediation Or Litigation, Which One Should You Opt For?

For more such stories, stay tuned to HerZindagi.

Image Courtesy: @zikiguy/Instagram/Freepik

Also watch this video

Herzindagi video

Our aim is to provide accurate, safe and expert verified information through our articles and social media handles. The remedies, advice and tips mentioned here are for general information only. Please consult your expert before trying any kind of health, beauty, life hacks or astrology related tips. For any feedback or complaint, contact us at [email protected].