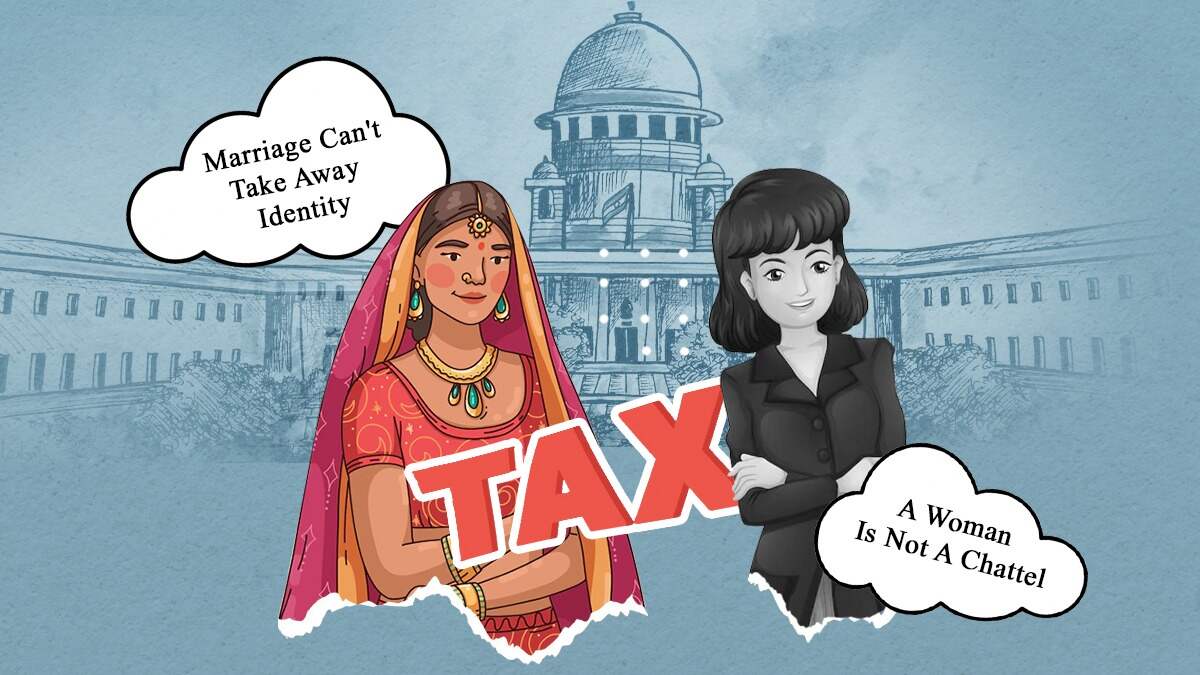

On January 13, the Supreme Court of India ordered to strike down a provision in the tax laws and called it “discriminatory” towards the women of Sikkim. A bench consisting of Justices BV Nagarathna and MR Shah observed, “a woman is not a chattel and has an identity of her own.”

In this article, we will explain what provision of the tax law discriminates against women of Sikkim and how.

We spoke to Swaralipi Deb Roy, a Corporate Lawyer & Practising at the Delhi High Court & Supreme Court of India, to get more clarity on the subject.

The apex court was hearing two petitions that challenged Section 10 (26AAA) of the Income Tax Act of 1961. The provision excludes Sikkimese women who have married out of the state or a non-Sikkimese person after April 1, 2008. They were curbed from availing exemption under the Act. Hence, the bench called it “discriminatory.”

The section lists incomes that are not included in the total income of a person. It reads, “In computing the total income of a previous year of any person, any income falling within any of the following clauses shall not be included — in case of an individual, being a Sikkimese, any income which accrues or arises to him — (a) from any source in the State of Sikkim; or (b) by way of dividend or interest on interest on securities: Provided that nothing contained in this clause shall apply to a Sikkimese woman who, on or after the 1st day of April 2008, marries an individual who is not a Sikkimese.”

It defines Sikkimese as those permanent settlers who have been a part of the state before its merger with India on April 26, 1975.

The petitioner said that the exemption of Sikkimese women from the tax law provision violates Article 14 (equality before the law), Article 15 (right against discrimination on the grounds of religion, race, caste, sex or place of birth) and Article 21 (right to life and personal liberty) of the Constitution.

The bench agreed with the petitioner and said “no justification shown” to exclude women who married non-Sikkimese from the provision. Therefore, “The discrimination is violative of Articles 14, 15 and 21 of the Constitution of India, which requires it to be struck down,” the justices ordered.

The court also said, “Marriage can’t take away the identity of a woman.”

Don't Miss: Supreme Court Bans ‘Two-Finger’ Test, Calls It ‘Patriarchal, Sexist & Unscientific’

Women have certain tax benefits over men in India. For example, a married woman can have up to 500 gm of gold, whereas an unmarried woman can have up to 250 gm of gold. “In fact, even a higher amount of gold can be left unseized based on the assessing officer’s discretion,” added Roy.

You might be familiar with the concept that many people in India buy a home in the name of their wife, mother (mother can decide surname), or daughter. The reason behind it is tax benefits. Roy pointed out that if a woman buys a home or if the property is in her name, there is a deduction in the interest that goes up to ₹2 lakhs in every financial year.

For people who do not know, if a married couple jointly owns a property and has separate earnings, they can claim for deduction in tax separately, though it will depend on the share of co-owners in the property.

Don't Miss: Justice BV Nagarathna: Dissenting SC Judge

Women also get the benefits of low stamp duty. In India, some states offer lesser stamp duty to women home buyers than men or those who register property in the name of women.

For example, in Delhi, a woman home buyer has to pay a 4% stamp duty, whereas a man pays a 6% stamp duty over the property.

Also watch this video

Herzindagi video

Our aim is to provide accurate, safe and expert verified information through our articles and social media handles. The remedies, advice and tips mentioned here are for general information only. Please consult your expert before trying any kind of health, beauty, life hacks or astrology related tips. For any feedback or complaint, contact us at [email protected].